As the weather starts to warm up in March 2025, investors are looking for ways to diversify their portfolios and generate passive income. One popular option is investing in Real Estate Investment Trusts (REITs). According to

Benzinga, REITs offer a unique opportunity for individuals to invest in real estate without directly managing properties. In this article, we will explore the best REITs to buy in March 2025, highlighting their potential for growth and income generation.

What are REITs?

REITs are companies that own or finance real estate properties and provide a way for individuals to invest in real estate without directly managing properties. They can be classified into several categories, including equity REITs, mortgage REITs, and hybrid REITs. Equity REITs invest in and own properties, while mortgage REITs invest in and own property mortgages. Hybrid REITs combine elements of both equity and mortgage REITs.

Benefits of Investing in REITs

Investing in REITs offers several benefits, including:

Diversification: REITs provide a way to diversify your portfolio and reduce risk by investing in a different asset class.

Income Generation: REITs are required to distribute at least 90% of their taxable income to shareholders, providing a regular income stream.

Professional Management: REITs are managed by experienced professionals, allowing investors to benefit from their expertise.

Liquidity: REITs are traded on major stock exchanges, providing liquidity and ease of buying and selling.

Best REITs to Buy in March 2025

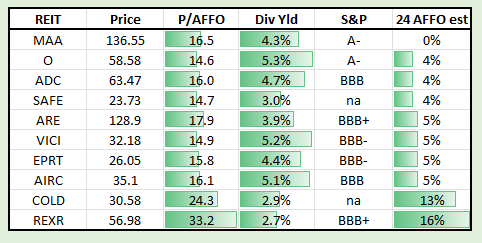

Based on market trends and analysis, here are some of the best REITs to buy in March 2025:

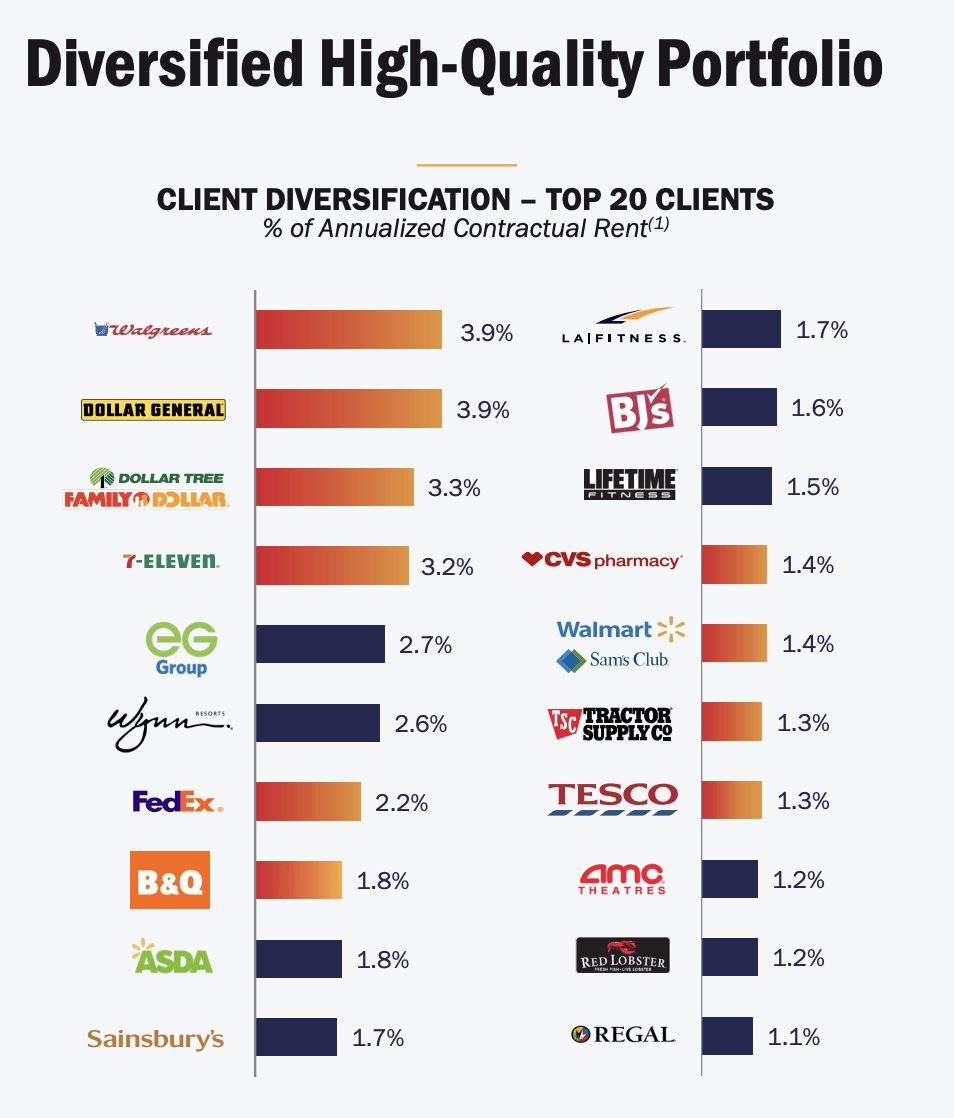

Realty Income (O): A retail REIT with a strong track record of dividend payments and a diversified portfolio of properties.

Simon Property Group (SPG): A retail REIT with a large portfolio of high-end properties and a history of consistent dividend payments.

Welltower Inc. (WELL): A healthcare REIT with a diversified portfolio of medical office buildings, outpatient facilities, and senior housing communities.

Mid-America Apartment Communities (MAA): A residential REIT with a large portfolio of apartments in the southern United States.

Ventas Inc. (VTR): A healthcare REIT with a diversified portfolio of medical office buildings, hospitals, and senior housing communities.

Investing in REITs can provide a unique opportunity for individuals to generate passive income and diversify their portfolios. By considering the best REITs to buy in March 2025, investors can make informed decisions and potentially benefit from the growth and income generation offered by these investments. As always, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

Remember to stay up-to-date with the latest market trends and analysis from

Benzinga to make informed investment decisions. With the right investment strategy, you can navigate the world of REITs and achieve your financial goals.